- The loan amount entirely relies on your revenue. The better your earnings, the greater amount of the mortgage matter might be supplied by lenders. Based on their specifications plus earnings, you might find the count as per your decision.

- Good credit indicates your installment and you will credit score, and that means you can get a loan during the a lower life expectancy notice rates. The rate continues to be the exact same on the tenure

- You could avail the mortgage instead pledging any beneficial property or safeguards or equity

- You’ll find lowest documentation and mortgage will get acknowledged within a few minutes

Version of Unsecured Personal loan

In order to get these types of financing, you only have to give your own signature to find the mortgage matter. Brand new signature was a guarantee the loan candidate have a tendency to pay-off the borrowed funds unfalteringly inside a designated go out. A signature loan is only considering only centered on your own creditworthiness.

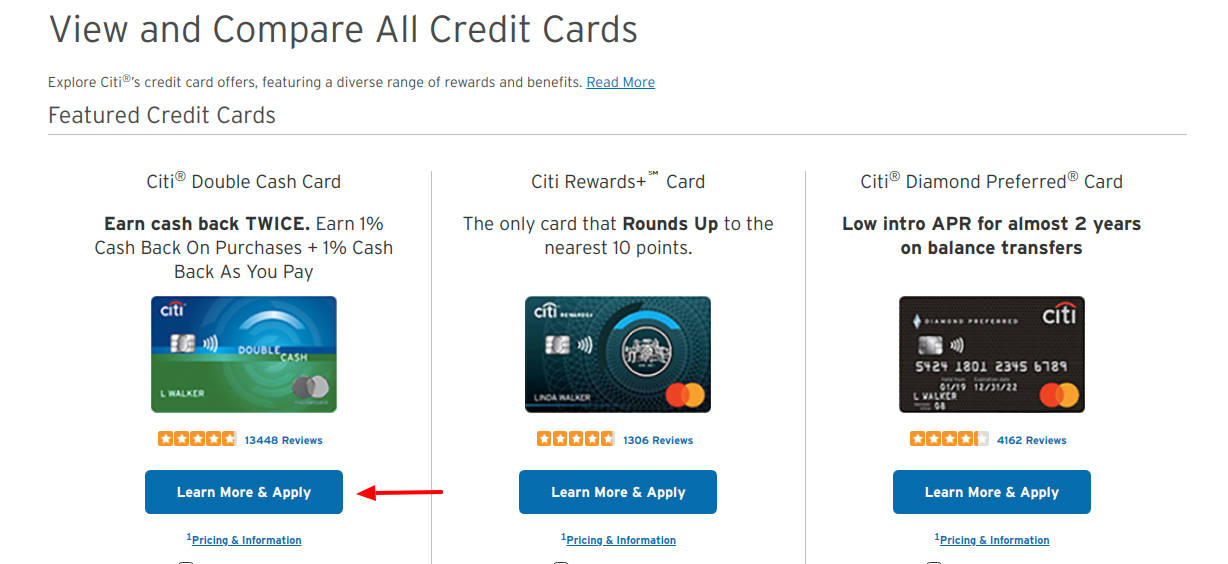

unsecured consumer loan. Utilising the cards, you can effectively get anything; not, the rate is quite large (24% in order to thirty six%) versus a signature financing. You might avail a charge card as the a loan for people who lack a significant credit history. It is best to go for lumpsum loan amount at start to make sure the optimum interest. Read More