FHA is short for to your Government Casing Administration. An FHA mortgage is actually a mortgage which is given by a keen recognized FHA bank and you can covered by FHA by itself. It is readily available for reasonable to help you modest money consumers that have all the way down credit ratings and you may a diminished lowest downpayment. Read More

Here you will find the key the thing you need to learn before you exit work now (or you currently work at home, one which just shutdown the computer).

Home loan Rates Change Four banking institutions modified carded repaired prices today, and all the changes were reductions. Our very own price tables have got all the changes up-to-date.

Label Put Rates Change Four institutions revised picked carded label put rates now, plus BNZ, Kiwibank, SBS Financial, the new Collaborative Bank, and you can Unity Currency. Read More

Now ‘s the big date we demystify signature loans plus the secret you to definitely border them. (Try not to care and attention, it’s just not you to difficult and you may weren’t planning to plunge too deep with the what signature loans is actually and how it works.)

Unsecured loans happen to be fairly easy. You borrow cash. You spend it on what you want to invest it to the (or at least need certainly to spend they with the). You make payments every month to blow back the cash your obtain.

Usually, signature loans come from loan providers-either on the internet-otherwise owing to old-fashioned banks and you will credit unions. Some times, customers as if you turn-to unsecured loans to make a purchase you to definitely does not keeps its loan-for example an auto loan or a mortgage-but to quit higher interest rates such as for instance handmade cards can hold.

Oh yeah, I almost forgot, the better your credit rating try, the greater the rate on a personal loan is likely to be. Since the personal loans is unsecured loans, the lending company is basing the borrowed funds on the credit rating.

Since that is straightened out, allows diving directly into 7 personal bank loan businesses that can get the money you want in your hot absolutely nothing hands now.

step 1. Bluish Trust Funds

If you’d like up to $1,250 within the cash, Blue Believe Loans might help. You could diary onto their website, sign up for the loan just in case approve, get it put into your bank account by the next company big date. In the event that implementing on the web doesnt provide the enjoying fuzzies, you’ll be able to provide them with a call plus they might help you of the phone.

The definition of of your own financing-how long you have got to pay the borrowed funds-could be to 6 months. Blue Trust Finance lack a great prepayment penalty you can pay off of the loan completely any time. Read More

Although not, shortly after utilizing it for a time, it is possible to know it is a beneficial product getting staff as well seeing that they offers plenty of parallels having Brigit.

You build a cover equilibrium from the finishing changes and then, once you’ve strike the lowest count, you might withdraw the cash quickly, as soon as their salary is available in, you’re not awaiting days or weeks to get your practical the money. The advance you really have gotten will be subtracted.

DailyPay costs a little commission of $1.twenty-five, which is the price of giving the improvement from your own DailyPay account towards the checking account. Other than that it transfer commission, there are not any almost every other fees involved, very profiles don’t get recharged month-to-month charges eg Brigit.

With this specific app, the fresh new insecurities one group keeps about their cash try greatly less, and are also able to live its life instead worry.

nine. Affirm

In the place of providing you with a lump sum of money upfront, they give you resource to suit your pick. Read More

No, you nevertheless still need a credit assessment when applying for an initial-label loan that have people Uk bank. two hundred lb money no borrowing from the bank inspections dont are present. Lenders want to see every piece of information on your credit reports therefore they’re able to come to a decision regarding the whether or not to provide to you personally or perhaps not.

If you’re approached of the a loan provider providing finance having 2 hundred lbs without borrowing inspections, please be wary. Most of the lenders have to perform this type of inspections in order to give responsibly. Through the use of as a consequence of ThisLender, you might assist to make sure that youre borrowing from the bank away from a trustworthy 200 lender.

Remember: ThisLender doesn’t manage a credit score assessment; loan providers have a tendency to done a delicate look in app techniques. For many who accept a creditors financing promote, they will certainly create a painful borrowing search.

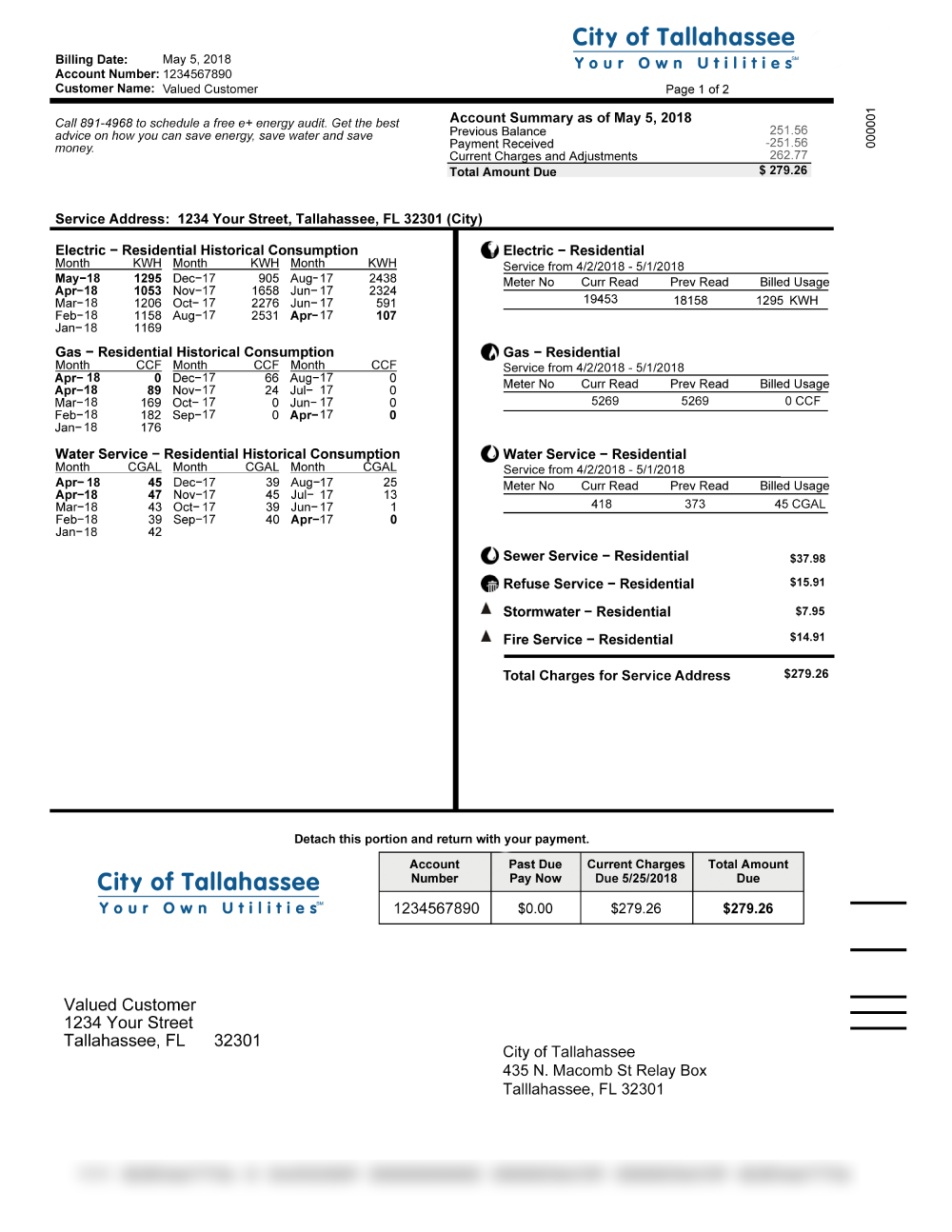

One benefit out of two hundred pound financing is you understand beforehand when you are necessary to initiate your payments. Just how you are expected to repay the 2 hundred lb loan might possibly be influenced by new lead loan providers small print.

Inside application phase, the financial institution will give you every required payment recommendations. This may outline the complete two hundred financing title, including any rates and you will costs.

After you start borrowing from the bank, the lender will require one make normal costs toward loan, if or not thats on your second pay-day otherwise one week from when you get your loan. Read More

We ran on the this example with a poor appraiserthank goodness that have Liz’s [the borrowed funds officer] help, we were capable of getting a new appraisal bought, plus it turned out better

That topic it is not always a downside, but instead something you should watch out for, is that the assets must appraise to your 1st mortgage amount + new repair costs, however it must appraise just before closing. So, such as, if the a home in its ongoing state are 100k, and you will restoration prices are 25k, the brand new appraiser should glance at the recommended extent of work, and you may appraise our house centered on their upcoming value just after renovations. Their agent are going to be essential in this step in buy to get comps and you will do the full CMA (comparative sector research) which will make yes you are not offering extreme for the possessions.

The largest drawback, definitely, for people try that individuals could not feel our own GC. My husband has a qualification during the and it has did inside the framework administration for several years, therefore we was in fact most bummed that we didn’t plan out the fresh new subs our selves. It lead to new timeline we had been informed are extremely wrong, with contradictory otherwise nonexistent interaction between your GC we selected and you can subs. We’d so you’re able to scramble for some days trying to puzzle out in which we had getting lifestyle because they was indeed very trailing. As soon as we wanted the new and right timelines, the answer is actually constantly a couple of more months. It absolutely was very stressful. Exactly what got a one-week schedule https://cashadvancecompass.com/loans/payday-loans-alternative/ turned five, due to the fact subs weren’t adequately informed on importance of the timeline. Got we simply come advised seriously upfront, we are able to enjoys pursued a short-term leasing. Read More

For those who have intentions to renovate your house otherwise make modifications towards home design, among issues that can get obstruct the arrangements try run out of out-of resource. If you don’t provides excess savings that are not linked to your own household bank account, you will be necessary to look somewhere else to acquire financing.

The following are ten financial institutions to apply for a house renovations loan:

Before you apply getting a renovation loan, you have got to guess the expense of the necessary home improvements. Read More

1 The rate for the Arm finance usually changes after the very first three, four, otherwise eight ages, and as a result, many banking institutions are conforming the very first time having regulating criteria amended inside the 2014. In this article, we’re going to defense the difficulties examiners identified as it connect with Arm speed modifications, establish just how to target these issues, and gives several approaches for dealing with compliance exposure in Case servicing.

Rates variations sees-timing

Whenever you are home https://paydayloanalabama.com/moody/ loan repair comes with numerous affairs, examiners found points related to after that Arm disclosures, and that revise individuals away from after that transform to their interest rates and you may payment numbers. The very first time the rate changes toward safeguarded money, 2 Controls Z makes it necessary that servicers deliver the observe at least 210 weeks but no more than 240 weeks prior to the deadline of the very first commission on newly modified rate (notices are only requisite in the event the interest causes a good switch to the fresh new fee). step 3 For next rates transform, Regulation Z necessitates that new servicer deliver the see 60 in order to 120 months prior to the very first fee underneath the adjusted rates. cuatro Examiners detailed that some financial institutions failed to send brand new sees far sufficient just before the alteration time to own fund subject to those Regulation Z criteria.

Rate variations observes-posts

Along with the time abuses, examiners learned that several finance companies did not are all the requisite disclosures on the notices. Read More

When your credit history are 750 and more, your odds of getting home financing raise rather, and also negotiate to own straight down interest levels towards the lenders.

- Follow You

- Mouse click to share to the WhatsApp (Reveals useful content within the the new windows)

Mortgage rates are rising, and you have to be thinking the best way to get the best revenue despite this carried on escalation in repo cost because of the Put aside Financial from Asia (RBI). If you are intending for taking home financing plus don’t learn how to check your eligibility, then first thing you need to have a look at can be your credit rating.

Credit history was a great three-finger matter ranging from 3 hundred and you can 900, determined from the credit bureaus. A good credit score explains are capable of your debts well and you may pay off him or her punctually. You’ll be able to get lucrative even offers on financial rates and playing cards. When you first sign up for home financing, your own bank commonly want to know regarding the earnings and check your own credit rating. Your credit score is provided in your credit file, hence summarises your past money, defaults, and you can mortgage liabilities.

Rising cost? Score below seven% rate of interest home loans predicated on your credit rating

If your credit rating is right, you can have several positives. One of the primary benefits associated with with good credit is that you could get a mortgage in the a lower interest. And additionally, their creditworthiness are high than others having lower credit ratings. Read More

The manner in which you intend to use the house may also affect their PMI rate. In the event your finances happens south, its easier to forget a rental domestic instead of the latest house your currently are now living in.

Try MIP Exactly like PMI

MIP, financial premium, ‘s the equivalent to individual financial insurance rates but also for government loans. If you are looking from the playing with a keen FHA mortgage or opposite mortgage, you happen to be lead so you’re able to home loan insurance fees.

The guidelines away from MIP have become like PMI apart from seeking to get rid of MIP. For one, you can not cure MIP out-of an enthusiastic FHA mortgage provided once the 2013. Once you have MIP on your own FHA financing, it might be there to the lifetime of the mortgage.

Just how to Clean out PMI

When discussing PMI, we have to see the loan-to-well worth (LTV) proportion. Read More