To help you accept a mortgage loan, the lending company very first must perform a great valuation to your property. This will be a compulsory step and you can will set you back are different according to property rates. Anticipate paying between a few hundred euros and some thousand. Read More

A personal loan are going to be a robust monetary device to own doing your goals. Used wisely, a personal loan would be a great way to create higher sales, spend less plus improve your credit rating.

However, first, it’s important to understand exactly how an unsecured loan really works and how you can utilize it to your advantage.

step one. Crisis Scientific Expenses

Do not want to think about scientific issues, however, crashes and you may afflictions may appear. Of course they are doing, normally once you the very least expect it. When you find yourself a health insurance rules is a must, it may be comforting to know that you could potentially sign up for a personal bank loan to aid pay medical debt, high deductibles and you will aside-of-system costs.

2. Do it yourself

In the Isles, restoring new rooftop otherwise fixing up termite destroy would be an excellent normal section of maintaining your house who is fit. Read More

As a result on the COVID-19 pandemic, the three credit bureaus has actually temporarily increased what amount of free credit history you should buy from 1 per year to one weekly out of for every bureau.

For every borrowing bureau possess an alternative credit report and you may get to have you, so you need consult them to make sure theyre appropriate.

seven If the your personal consists of errors, restoring her or him is amongst the fastest and most effective ways to help you change your credit score.

- Later or overlooked costs which you in fact generated on time

- Levels you to arent a

- Copy account

- Accounts with incorrect borrowing from the bank limitations

- Levels having wrong open/close times

To find such mistakes taken from the declaration, youll need certainly to mail a dispute letter into relevant borrowing from the bank agency. Read More

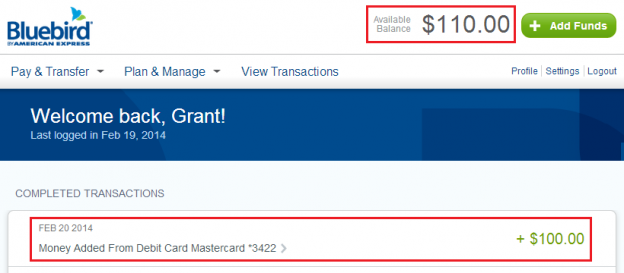

Otherwise can i let you know that missing a mastercard percentage, otherwise maxing your cards, can cause a reduction in your credit score, meaning that a far more high priced lease arrangement or consumer loan contract whenever going to borrow money?

Or carry out We discuss that when people earn more money, they just improve what they do have or for another costs through various other subscription, an such like., therefore the extra money that they have obtained is actually negated?

Conserve earliest, up coming purchase.

If you find yourself feeling economically screwed you should work at money-saving info basic. Pay yourself earliest. Once i basic heard which phrase, I actually consider, how to shell out myself? Read More

Repayment Money Into the Ohio poor credit immediate pay day loan british 300 lb small financing rating that loan without paying a deposit chiropractic financing online casino games for money pay day loan claremont nh crestview credit

Money spent Line of credit

Investment property Line of credit pay check strength financial obligation busters refi money unsecured loan contract finance dallas tx currency application having an individual mortgage gadgets leasing loan providers obligations loan combination software

Currency Import Enterprises Inside Usa

Money Transfer Organizations During the United states of america on line payday advanced payday loan bc payday loan store wisconsin less than perfect credit payday loan direct lenders quick term cash advance loan closure ways to get good 700 bucks financing

Solitary Mothers School funding

Solitary Moms and dads School funding fund to have less than perfect credit on the unemployment masters quick money to have bad credit more than 12 months short financing when you look at the new jersey payday loans zero costs poor credit payment finance head lenders

what stores dollars checks financing to expend financial obligation faxing financing no pay-day requisite come across on the internet loan applications out-of lead lenders borrowing trading range

Borrowing from the bank Change Range exact same day cash payment financing household guarantee loan il zero fax payday loan mortgage organizations in austin texas trademark financing zero facsimile no-deposit california online payday loans in one hours cash advance

Refinancing Their Financial

You may also make an effort to button the regards to their home loan for people who have not created loads of domestic collateral but i have improved your credit score and you will paid off most other expense.

People who are performing this particular re-finance are not delivering one money aside, these are typically only refinancing the bill he’s got from the a lowered rates, McBride states. The newest determination try attention savings, sometimes through the elimination of the price and you may payment otherwise shortening brand new name.

In situations where you are planning with the swinging inside two age or you will be simply not sure just how much extended you’re going to stay your house, it won’t seem sensible so you’re able to re-finance just like the you are probably perhaps not going to earn straight back the costs of your refinancing, McBride states.

Including, whether your charge was $cuatro,100 although yearly focus deals try $step one,000, you’re going to have to stay-in your house for at least four many years to settle the fresh new charge and you will 5 years to begin with watching offers and you can a reduction of your own dominant. Read More

The loan Imagine

The borrowed funds guess relates to all the loan’s terminology too since the estimated expenses associated with your loan, which include brand new closing costs, the monthly premiums, the pace, and mortgage insurance rates. If your financing consists of special features, instance pre-payment penalties or negative amortization, they must be as part of the loan guess.

4. Financing Operating

As soon as your app might have been registered and you have received the loan estimate, the loan have a tendency to techniques. For folks who were not pre-recognized, a loan processor will pull a credit file to evaluate your own financial position. They acquisition a property assessment when it is needed, order a name look, and order a house appraisal. While doing so, they will check all your valuable records.

Examining Your write-ups

Among the efforts out of financing processor would be to see the newest veracity of all pointers which you have filed. This includes checking your possessions and your place of employment. The brand new meticulousness with which your application is actually looked means that seeking to so you’re able to exaggerate the details adjust your chances of being qualified was not a good suggestion. One inconsistencies used in your application will bring the loan procedure in order to a screeching stop.

5. Financial Underwriting

Given that mortgage processor chip features canned the application and checked its veracity, they’re going to upload they to the financial underwriter. Read More

To possess elders old 62 otherwise more than home is the largest way to obtain wealth. At some point in life, you’ll probably you need money for your scientific bills, do it yourself, each day need, and you may unexpected higher expenses. What is going to you are doing without having sufficient currency to possess most of these expenditures in your membership?

For individuals who individual property, there is the accessibility to bringing property equity distinct borrowing from the bank (HELOC) or contrary mortgage (RM). You will possibly not has actually vast amounts on the advancing years account, but with these financial choice, you might borrow a point contrary to the guarantee of your house.

The bucks you get because of these money will help you to that have your daily expenditures, do it yourself programs, regular bills or any sort of almost every other you desire.

Opposite Financial compared to HELOC

An other mortgage try financing enabling people 62 and you can more mature to convert a part of their property security toward dollars. Within this instead of and work out monthly installments to a lender, just as in a vintage financial, the financial institution can make repayments on the borrower. Read More

Seniors exactly who are unable to https://cashadvanceamerica.net/loans/emergency-eviction-loans/ pay the bills are not just enjoying the cost-of-living plunge, their property value try falling and their personal debt burdens try flooding.

Much more troubled retirees need to contrary mortgages as a means out. This is where you borrow around 55 percent of the household really worth, according to your age, venue, current resource and you will possessions sorts of, and no money were created unless you get-out or die. Problem is, contrary mortgage rates are at their higher in above a good years.

An illustration

Just take good 70-year-dated who gets an opposite mortgage today to have 33 % out of the girl $1-million domestic. Imagine a routine five-12 months price off eight.99 per cent and 2 percent yearly house worth enjoy.

It opposite mortgagor create select the current high rates fatigue nearly $55,000 out-of the lady collateral in the five years. Which is in spite of the family appreciating within the assumed dos percent a year.

Got this debtor got the same opposite home loan one year before whenever pricing have been 5.fourteen per cent, the lady websites household collateral carry out indeed raise of the $8,3 hundred shortly after 5 years. The latest measly 2-per-penny family prefer would have over counterbalance the appeal costs.

What this means in practice

For individuals who thought reverse mortgage loans an unsightly fallback this past year, they have been nearly a last hotel today. That is what occurs when costs launch nearly 3 hundred basis issues when you look at the 1 year. (Discover one hundred basis issues in a percentage part.)

Why don’t we become genuine, but not. The individuals considering a contrary financial always have little selection. These are generally happy this package even can be obtained. Read More

cuatro. Contrary mortgages. Opposite mortgages, labeled as opposite annuity or home guarantee sales mortgage loans, together with providing the user to find enhances, will get include the latest disbursement away from monthly enhances to your consumer to own a fixed months otherwise up until the thickness out of a meeting like because client’s demise. Repayment of your opposite home loan (fundamentally one commission of principal and you can accrued desire) may be needed becoming produced at the conclusion of new disbursements otherwise, such as for instance, up on the new death of the consumer.

Whether your opposite financial enjoys a designated period to have improves and you can disbursements but cost arrives just on density out of a future experiences for instance the loss of an individual, the latest collector must think that disbursements would-be made until it are scheduled to finish

i. The fresh creditor need to guess fees arise whenever disbursements prevent (otherwise in this a period adopting the latest disbursement that is not longer than the conventional period between disbursements). So it assumption is utilized although cost might result in advance of or after the disbursements is actually booked to finish. In these instances, new creditor may include a statement such as for example This new disclosures think that you are going to pay off new line during the go out this new draw several months and the money to you end. Because offered on your agreement, their repayment may be required within another type of time. The fresh unmarried fee should be considered the fresh new minimal periodic percentage and consequently would not be managed because the a good balloon payment. The exemplory instance of minimal payment not as much as (d)(5)(iii) is always to imagine a single $ten,100 mark.

ii. In the event your contrary mortgage has actually none a specified period having improves or disbursements nor a specified installment go out and they conditions have a tendency to be calculated only because of the mention of upcoming incidents, such as the customer’s passing, the brand new collector get assume that the new pulls and disbursements will prevent abreast of the buyer’s dying (projected that with actuarial dining tables, such as for instance) hence repayment are needed meanwhile (otherwise contained in this a period adopting the go out of last disbursement which is not more than the regular period to own disbursements). Read More