California are an extraordinary location to real time, besides whilst has a lot of places observe, beaches to check out, and Disneyland to see, and since condition offers numerous effective Federal Education loan Forgiveness Apps so you can citizens tucked in school mortgage loans.

Whoever resides in the new Golden State and you will who’s struggling employing money should pay attention, given that California’s education loan forgiveness programs rating amongst the best in the entire nation, giving exceptional positive points to people who qualify for this new award.

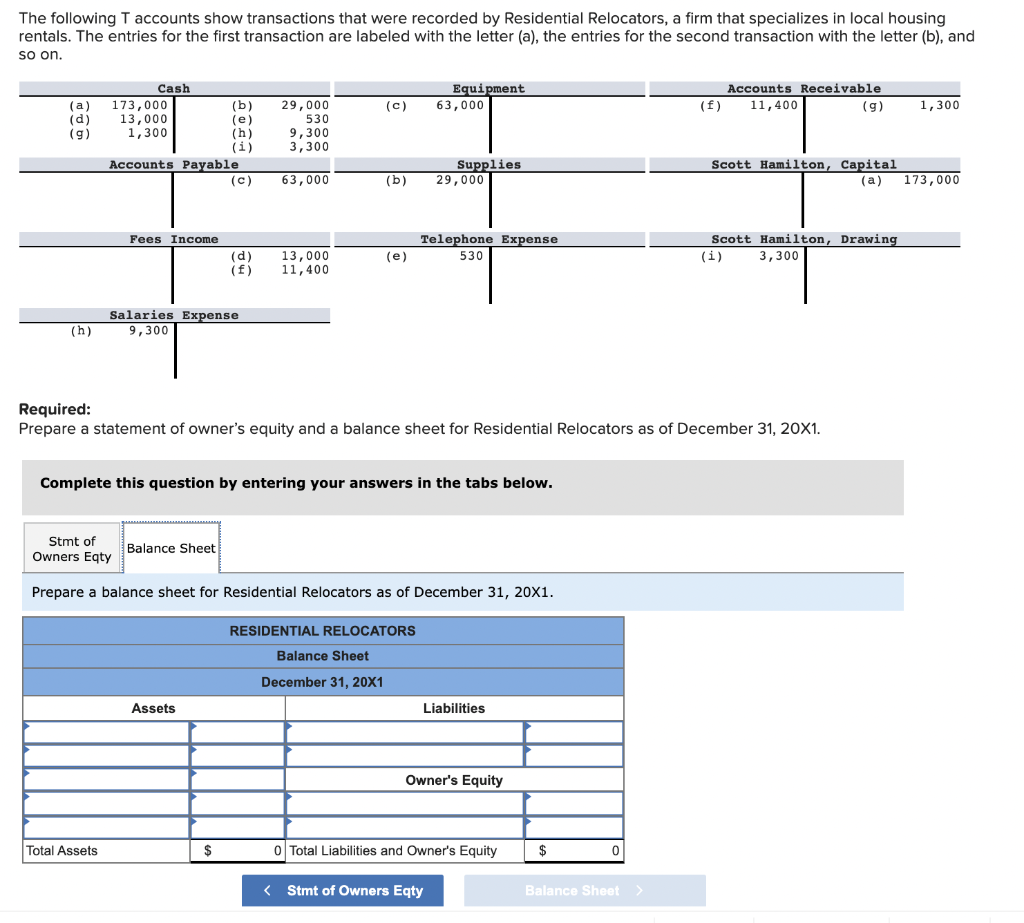

For education loan forgiveness when you look at the California, you will need to feedback this new available forgiveness programs less than, using close attention on their Qualifications Regulations, and you may App Steps to choose and that program are working perfect for you.

Score Assistance with Their Financing!

If you find yourself it is enduring student loan loans, you then must look into paying an educatonal loan Debt relief Service to own help. Why? Because the people working in the these firms manage college loans all day, daily, plus they are the best chance at the learning ways to get their finance back manageable.

For assistance with Federal Figuratively speaking name the latest Education loan Rescue Helpline at the step 1-888-906-3065. They will review your case, view the options getting modifying payment preparations, combining the funds, otherwise pursuing forgiveness positives, next establish you to finish the debt due to the fact quickly to.

Having advice about Private Figuratively speaking label McCarthy Rules PLC at 1-877-317-0455. McCarthy Legislation have a tendency to negotiate along with your bank to repay your individual financing having a lot less than simply your currently owe (typically forty%), upcoming allow you to get a separate loan into the all the way down, settled count in order to repay the old mortgage, fix your own credit and relieve your own monthly obligations. Read More

/cloudfront-us-east-1.images.arcpublishing.com/gray/QJYUT6KECRBFPJVLRUF62FQ37U.jpg)