While looking property, then you are probably looking for mortgage loan, also. Within techniques, you might find the name LendingTree.

In the event it is far from a mortgage lender of the in itself, LendingTree makes it possible to find mortgage to invest in your property pick. With the tagline Could possibly get an educated financial earnings, its an internet segments providing you to definitely evaluation-identify a myriad of money. They’ve been mortgage loans, car loans, do-it-yourself finance, however some.

The business lead in to the 1998 as well as have served over 100 mil people given that. Still, despite the record, LendingTree’s services in reality right for anyone-nor is it usually alot more cheap choices. Are you presently playing with LendingTree for your house financing? Naturally feel the entire picture earliest.

Just how LendingTree Performs

LendingTree is designed to boost the lent loans-search procedure giving users numerous funds also provides every to help you your one single-gang of suggestions. To your top-end, consumers number in order to LendingTree’s webpages, enter into type of 1st search, and discovered to four possible financing options using most recent email address. ? ?

- Loan form of-basic score, refinance, family defense

- Property type of-single-family members, condominium, if you don’t flat

- Property use-zero. step 1 home otherwise travel possessions

- To shop for timeframe

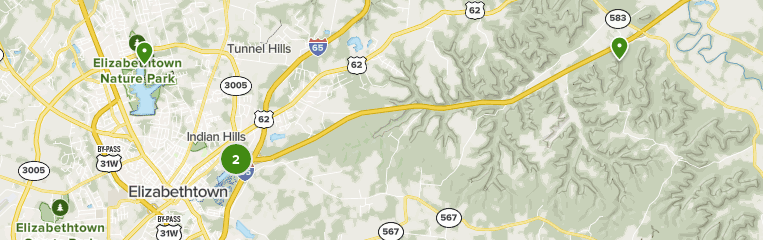

- Location of the assets

- Spending plan and you can off-payment count

- Common lender

- Domestic money

- Credit history

- Social Coverage Count

On the back-end, lenders indeed spend LendingTree getting the latest offers offered to profiles. The bank will pay LendingTree a charge, passes to their mortgage criteria, and LendingTree spends one data to match pages which have to help you four prospective financing.

Advantages and disadvantages of employing LendingTree for your home Resource

One of the benefits of using LendingTree is that it allows you to save time and you may problems. In place of filling out four separate types if not and work out worldpaydayloans/payday-loans-va four separate phone calls, you should use get the ball moving into several financing prices in just a single shipping.

The biggest drawback out of LendingTree is the fact simply a great couple home loans participate in the firm. Which means that not buy the faster-can cost you mortgage available to your own from industries, there may actually bringing a cheaper, non-LendingTree bring out there which is a better complement.

Another grand disadvantage would be the fact LendingTree bargain candidates and you may browse. It means once you’ve joined your data, they promote so you’re able to creditors who want to compete for the business. It usually results in an onslaught away-off characters, calls, and organization characters away from loan providers hoping to bring your own to the financial support choice.

LendingTree’s even offers are available myself, thanks to emails aside-away from each matched up lender. This will allow difficult to evaluate money possibilities, as each possess different costs, factors, APRs, requirements, and other situations. Your most likely you would like good spreadsheet otherwise calculator beneficial so you’re able to work through the leader.

Approaches for Victory

Just in case you always explore LendingTree to gauge your residence financing and other resource choice, upcoming imagine starting an effective spreadsheet or any other file to help you properly evaluate the brand https://paydayloanalabama.com/grimes/ new offers. Create articles which have interest rate, ount, financial name, section will set you back, and other details. Make certain that you will be researching oranges to apples when investigating for every single financing provide receive.

You should also have a notable idea regarding what you might be looking providing when finishing their LendingTree mode. Knowing the finances you are searching to search within the, the spot for which you will end up buying, plus credit rating and you can house income is perhaps all make it easier to advance, more well-eliminate mortgage alternatives for your home buy.

Eventually, try not to put in their LendingTree app if not are set (otherwise most close to) buying your family relations. Considering LendingTree itself, youre unable to terminate your loan consult in place of needing most of the matched monetary really. You’re going to have to installed an alternate financing request for people who desire to right up-go out otherwise change the look you joined on mode. Waiting or even are practically happy to get may help get rid of copy apps, plus premature calls and you will emails regarding hopeless mortgage providers.