Regularly organizing and updating your books can help you catch that erroneous overdraft fee today, rather than six months from now, when it’s too late to bring https://newsnight.ru/the-business-insider-ssha-vydayut-rossii-kritikov-kadyrova/ up. If you use cash accounting, you record your transaction when cash changes hands. The basic financial statements reflect the condition of your business.

Best Free Accounting Software for Small Businesses of 2024

- Your bookkeeper can then correctly classify those types of transactions.

- Bookkeeping is a skill used in both large companies and small businesses, and bookkeepers are needed in almost every business and industry.

- You can also compute for yourself if your business is earning and whether you are paying the correct taxes to the BIR.

- It also provides information to make general strategic decisions and a benchmark for its revenue and income goals.

- Bookkeeping software automates many aspects of financial management, including transaction recording, expense tracking, and financial reporting.

Organize receipts by categories such as office supplies, travel, and meals to simplify tracking and reporting. With proper receipt management, you can avoid missing out on deductible expenses and facing challenges during audits. If your operating cash flow has decreased, then you might reassess some of your operating costs or pricing. One of the most important purposes of bookkeeping is to help you make better, more profitable decisions.

Bookkeeping Basics and Initial Steps

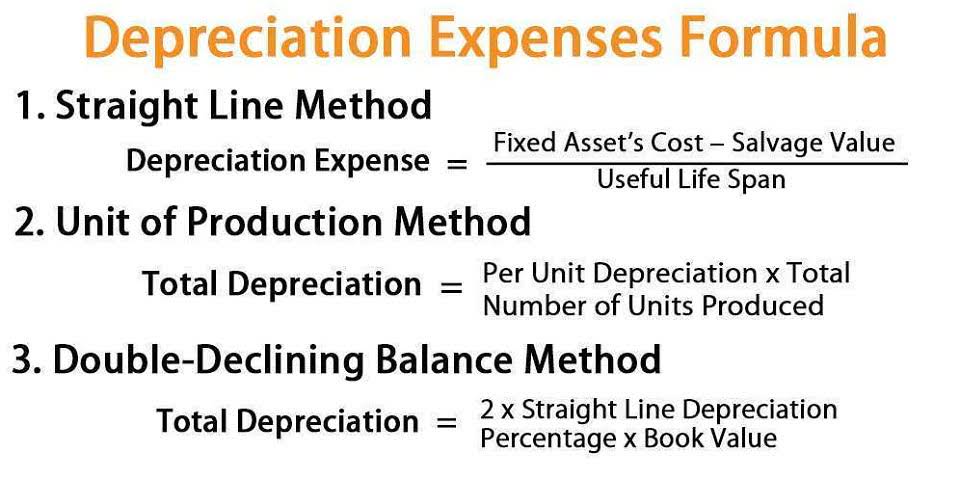

Each one of these is designed to track specific types of business transactions. For example, there’s cash basis accounting and accrual basis accounting. You need to decide which accounting method you will use for your company.

Step 3: Choose an accounting method: Cash or Accrual

- As a small business owner, she is passionate about supporting other entrepreneurs and sharing information that will help them thrive.

- You’ll benefit from bookmarking this glossary which is full of bookkeeping terms (no confusing jargon though) that we’ll regularly update.

- However, paper-based records are more time-consuming to complete and do not give you the same flexibility as a computer system when compiling the income statement and balance sheet.

- The question is whether or not you as the business owner with limited knowledge want to do this job yourself or hire the services of a professional.

- After you get the net income for the period, their net effect would either increase or decrease your capital balance.

If you still feel like you need outside help to manage your finances and can afford the investment, hiring a bookkeeper can be an ideal solution. Bookkeepers and accountants are both critical for the financial health of a company. If you’re not tracking daily expenses, you’ll have very little information to give to your accountant and they won’t be able to make informed decisions. If you’re only focusing on expenses and not big-picture financial data, you’ll miss out on some strategic opportunities. The cash flow statement shows how transactions from the balance sheet and income statement affect your cash account. This is the first course in a series of four that will give you the skills needed to start your career in bookkeeping.

It is used by many small businesses and charities, as well as for personal use. You can use simple bookkeeping forms if you don’t want to use a computer system. According to ZipRecruiter, as http://www.theauctioncompany.net/about-us/ of July 2021, the average annual pay for a freelance bookkeeper in the United States is $55,094 a year. This works out to be approximately $26 an hour, over $1,000 a week, or $4,600 a month.

Common Roles in Accounting

Wave provides a cloud-based solution for businesses looking to do their bookkeeping themselves. It’s a great choice if you’d like to manage your finances from anywhere and won’t require additional assistance. Xero is a great option if you deal with any international transactions or have multiple currencies. It offers real-time cloud bookkeeping, and also gives you access to certified accountants. It’s a great choice for any business that needs financial support and advice from its bookkeeping app.

Doing so lets you produce financial statements, which are often a prerequisite for getting a business loan, a line of credit from a bank, or seed investment. Revenue is all the income a business receives http://topworldnews.ru/2011/12/13/cerkov-ne-mozhet-ne-zalezt-v-politiku/ in selling its products or services. Costs, also known as the cost of goods sold, are all the money a business spends to buy or manufacture the goods or services it sells to its customers.