The permanent withdrawal from use in a trade or business or from the production of income. A method established under the Modified Accelerated Cost Recovery System (MACRS) to determine the portion of the year to depreciate property both in the year the property is placed in service and in the year of disposition. The total of all money received plus the fair market value of all property or services received from a sale or exchange. The amount realized also includes any liabilities assumed by the buyer and any liabilities to which the property transferred is subject, such as real estate taxes or a mortgage. A ratable deduction for the cost of intangible property over its useful life. Generally, for the section 179 deduction, a taxpayer is considered to conduct a trade or business actively if they meaningfully participate in the management or operations of the trade or business.

To Ensure One Vote Per Person, Please Include the Following Info

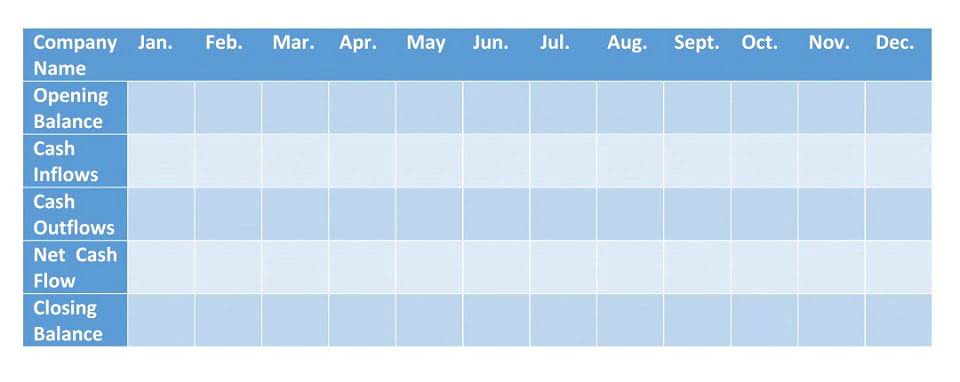

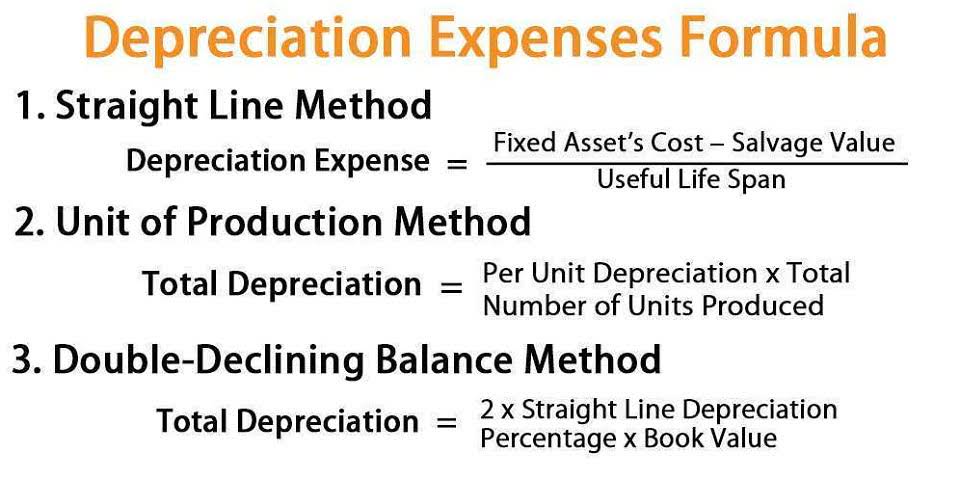

You multiply the reduced adjusted basis ($173) by the result (66.67%). If this convention applies, you deduct a half-year of depreciation for the first year and the last year that you depreciate the property. You deduct a full year of depreciation for any other year during the recovery period. Figuring depreciation under the declining balance method and switching to the straight line method is illustrated in Example 1, later, under Examples. Qualified rent-to-own property is property held by a rent-to-own dealer for purposes of being subject to a rent-to-own contract. It is tangible personal property generally used in the home for personal use.

- Depreciation allowed is depreciation you actually deducted (from which you received a tax benefit).

- Depreciation quantifies the declining value of a business asset, based on its useful life, and balances out the revenue it’s helped to produce.

- In some cases, you may change your method of depreciation for property depreciated under a reasonable method.

- The OPI Service is a federally funded program and is available at Taxpayer Assistance Centers (TACs), most IRS offices, and every VITA/TCE tax return site.

- The events must be open to the public for the price of admission.

- The cost of land generally includes the cost of clearing, grading, planting, and landscaping.

Causes of Depreciation

Any payment to you for the use of the automobile is treated as a rent payment for purposes of item (3). A normal retirement is a permanent withdrawal of depreciable property from use if the following apply. The IRS automatically approves certain changes of a method of depreciation. It is important for you to accurately determine the correct salvage value of the property you want to depreciate. You generally cannot depreciate property below a reasonable salvage value. The useful life can also be affected by technological improvements, progress in the arts, reasonably foreseeable economic changes, shifting of business centers, prohibitory laws, and other causes.

Let a small business tax expert do your taxes for you

For this purpose, the adjusted depreciable basis of a GAA is the unadjusted depreciable basis of the GAA minus any depreciation allowed or allowable for the GAA. The unadjusted depreciable basis and depreciation reserve of the GAA are not affected depreciable assets by the disposition of the machines. The depreciation allowance for the GAA in 2025 is $1,920 [($10,000 − $5,200) × 40% (0.40)]. You can use either of the following methods to figure the depreciation for years after a short tax year.

You make a $20,000 down payment on property and assume the seller’s mortgage of $120,000. Your total cost is $140,000, the cash you paid plus the mortgage you assumed. A partnership acquiring property from a terminating partnership must determine whether it is related to the terminating partnership immediately before the event causing the termination.

- Prorate this amount for the 8.5 months in 1995 that you held the property.

- The safest and easiest way to receive a tax refund is to e-file and choose direct deposit, which securely and electronically transfers your refund directly into your financial account.

- The DB method provides a larger deduction, so you deduct the $320 figured under the 200% DB method.

- The last quarter of the short tax year begins on October 20, which is 73 days from December 31, the end of the tax year.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

- You treat dispositions of section 1250 real property on which you have a gain as section 1245 recovery property.

Generally, these systems provide different methods and recovery periods to use in figuring depreciation deductions. On July 1, 2023, you placed in service in your business qualified property (that is not long production period property or certain aircraft) that cost $450,000 and that you acquired after September 27, 2017. You deduct 80% of the cost ($360,000) as a special depreciation allowance for 2023. You use the remaining cost of the property to figure a regular MACRS depreciation deduction for your property for 2023 and later years. If you file Form 3115 and change from an impermissible method to a permissible method of accounting for depreciation, you can make a section 481(a) adjustment for any unclaimed or excess amount of allowable depreciation.

In chapter 3, and Figuring the Deduction for Property Acquired in a Nontaxable Exchange in chapter 4. A person is considered regularly engaged in the business of leasing listed property only if contracts for leasing of listed property are entered into with some frequency over a continuous period of time. This determination is made on the basis of the facts and circumstances in each case and takes into account the nature of the person’s business in its entirety. For example, a person leasing only one passenger automobile during a tax year is not regularly engaged in the business of leasing automobiles. An employer who allows an employee to use the employer’s property for personal purposes and charges the employee for the use is not regularly engaged in the business of leasing the property used by the employee. The limitations on cost recovery deductions apply to the rental of listed property.

If you deducted an incorrect amount of depreciation in any year, you may be able to make a correction by filing an amended return for that year. If you are not allowed to make the correction on an amended return, you may be able to change your accounting method to claim the correct amount of depreciation. Use Form 4562 to figure your deduction for depreciation and amortization. Attach Form 4562 to your tax return for the current tax year if you are claiming any of the following items. There are also special rules for determining the basis of MACRS property involved in a like-kind exchange or involuntary conversion when the property is contained in a general asset account. You can elect to deduct state and local general sales taxes instead of state and local income taxes as an itemized deduction on Schedule A (Form 1040).