Article Note: The content with the blog post will be based upon the author’s opinions and you can guidance alone. May possibly not have been examined, commissioned or otherwise supported because of the any of our very own circle couples.

60Month Financing without delay

A good 60Month Loan consumer loan is perfect for people that you would like so you’re able to obtain four figures rapidly and certainly will pay it off before high APRs bring their unwieldy perception. While the business does a smooth credit score assessment in order to price men and women double-finger costs, in addition utilizes your cash move to decide the qualification – you are required to render their last three monthly bank comments up on using.

Money come in a dozen claims – continue reading our very own 60 Month Financing comment to choose whether or not it device is effectively for you.

- No very early fees penalties: 60 Day Financing doesn’t charges punishment for very early fees of your financing.

- Origination commission can be applied: That loan payment of up to 5% of one’s mortgage continues.

- Smooth credit query: A smooth borrowing from the bank query could be always look at your qualifications, and this would not connect with your credit rating.

- No cosigning possibilities: 60 Week Fund cannot supply the option of making an application for a great loan with an excellent cosigner.

Quick birth out-of loans: When the acknowledged, you can acquire your own money from the 2nd working day, which is of good use if you find yourself from inside the good bind.

sixty Week Money conditions

- Minimal credit rating: Not specified (financial does state they allows bad and you can fair borrowing)

- Minimal credit rating: Maybe not given

- Restriction loans-to-income ratio: Maybe not given

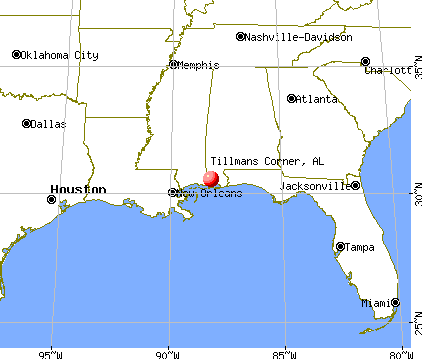

60 Month Loans reviews applications in the adopting the states

- Alabama

- Ca

sixty Month Loans costs

As previously mentioned a lot more than, 60 Day Financing fees Doing 5% of the mortgage continues due to the fact a keen origination fee, very you’ll want to discover more about these can cost you with regards to of the financing before signing for this. Additionally, there are no fees to possess very early cost of your own mortgage.

Who has got an educated fit for a good 60 Month Loans unsecured loan?

60 Week Loans’ consumer loan can be a good fit for individuals who require fast access to help you funds. And while 60 Week Loans’ credit limitations is limiting compared to other lenders, it can has a healthy selection of name lengths.

A massive how much to take out loans for medical school staying section for this bank is actually their cost. If you have expert credit, you ought to lookup in other places to possess an unsecured loan just like the competition will receive straight down prices. sixty Week Loans’ origination percentage (Doing 5% of the loan proceeds) is generally large, as well, based on your circumstances.

But not, when you have very high-interest debt and you will adequate credit, which bank may make sense, whenever you could potentially be considered on the budget of the pricing. Regrettably, if you are against personal credit card debt, you might find sixty Month Loans’ rates not to be your best bet to possess refinancing it.

What consumers are saying from inside the 60 Day Financing studies

To your LendingTree, sixty Month Funds provides a complete rating regarding cuatro.cuatro out of 5 and a good 87% recommendation rate. Borrowers possess stated various other experiences doing customer service.

One to came across debtor off Fultondale, Al., stated: Most elite and you will prompt solution! I found myself pleasantly surprised towards the terms. Closure try quick. Cash in my personal account in 2 days!

Simultaneously, borrowers of Vent Hueneme, Calif., and you can Ripon, Wis., offered the company you to definitely-celebrity ratings, complaining on the slow customer care per its application and installment.

Trying to get a consumer loan from 60 Day Fund

To try to get an unsecured loan regarding 60 Few days Funds, you will have to submit an application on the web. The application have a tendency to ask you to render the a career and you can financial advice and many help documentation, together with your history 90 days from financial comments. A softer credit check is generally held to choose your capability to pay off your loan.

Money might possibly be directed into your money just as the next business day due to an automatic clearing family, minus one relevant origination fees.

Selection in order to 60 Week Finance

Whether or not it 60 Times Loan review helps to make the bank popular with you or not, it seems sensible to shop doing together with other organizations to discover the greatest complete product to your requirements.

Delighted Currency vs. sixty Day Finance

Happier Money (formerly Rewards) even offers a wider variety of words, straight down interest rates and you may charges, and higher loan number (as much as $forty,000) than just quite a few of their competitors. When you have good credit score and many numerous years of credit history, which economic features agency might possibly be a viable substitute for your.

As well, Happy Currency now offers free attributes to simply help consumers greatest perform money, in addition to month-to-month FICO Rating position and you may offered tests meant to support their reference to money.

Marcus by Goldman Sachs versus. sixty Times Funds

ounts around $40,100 and you can will not costs whatever costs after all. Other brighten this financial offers: If you make twelve or maybe more on the-go out consecutive monthly obligations, you happen to be allowed to delayed you to payment as opposed to accruing most interest.

The process will not bear people charge that will be seemingly small -plus, centered on Marcus, fund are placed directly into the new borrower’s account in as little as 3 days.

Discover Bank versus. 60 Day Fund

Get a hold of Unsecured loans has the benefit of zero-payment personal loans having extended repayment terms than simply the majority of its competition – ideal for borrowers looking autonomy. Oftentimes, you could potentially discover approval an identical time you implement and birth of one’s loans of the second working day – as well as, you also can pick to get the fund sent straight to creditors. Finance are available in most of the states and you can customer care is even in your area mainly based.

Brand new Annual percentage rate range from six.99% so you can % Apr according to creditworthiness during the lifetime of app. Funds doing $thirty-five,100. Quick & Easy Procedure. Terms is actually thirty six so you’re able to 84 days. No prepayment punishment. This isn’t a strong provide out of borrowing. Any results presented was estimates therefore do not make sure the usefulness or accuracy with the certain circumstances. Eg, for a good $15,100000 mortgage that have an apr away from % and sixty day name, the fresh new projected payment could be $326. The newest projected total cost of one’s financing within example manage be $19,560.